Working together, for you

Company Affiliates

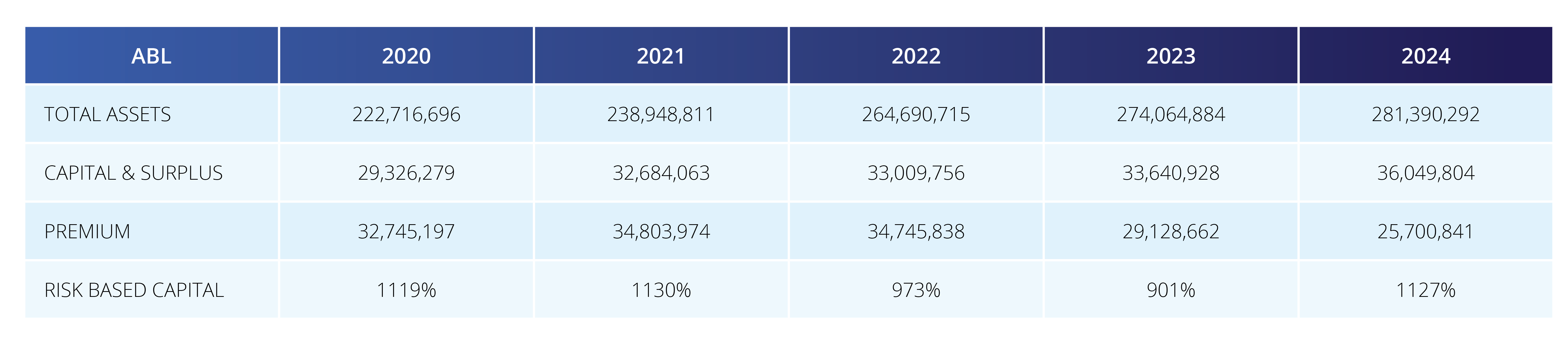

American Benefit Life Insurance Company

In 1909, American Benefit Life Insurance Company (ABL) became the first chartered life insurance company in Oklahoma. It was purchased by the Liberty Bankers Insurance Group in 2002 and operated as Mid-Continent Preferred Life until 2009 when its name was changed to American Benefit Life.

Now headquartered in Dallas, Texas, American Benefit Life has strategic relationships for reinsuring pre-need and whole-life insurance business since 2004. With this steady source of growth, American Benefit Life now insures over 15,000 lives in the state of Texas. In addition, American Benefit Life continues to act as a reinsurer for other companies by purchasing blocks of pre-need and whole-life business.

American Benefit Life is rated A- by AM Best Company, the most recognized rating agency for the insurance industry.

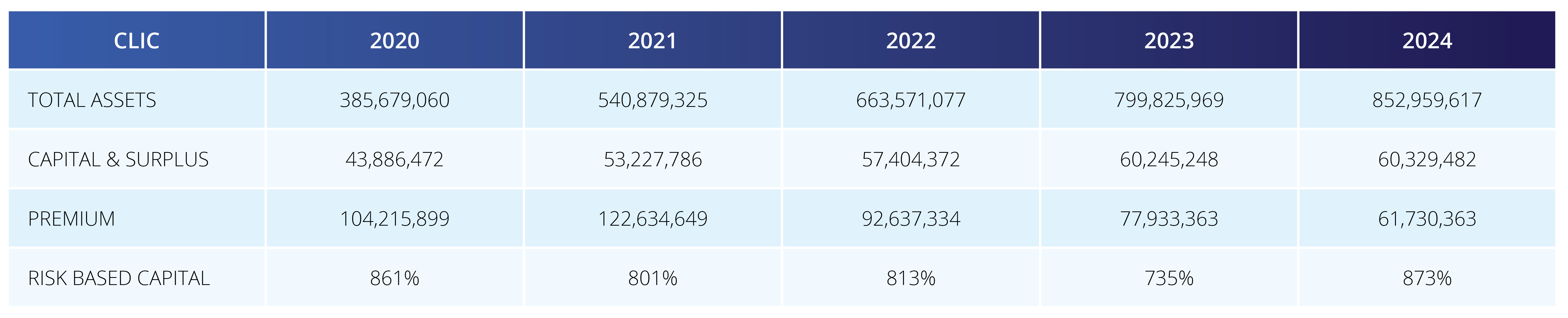

Capitol Life Insurance Company

Capitol Life Insurance Company (CLIC) was established in 1906 as the first charter in the state of Colorado. Liberty Bankers Insurance Group purchased the company in 2007, moving its headquarters to Dallas, Texas. CLIC markets a full line of life insurance and annuity products to states licensed to sell Liberty Bankers Life products.

CLIC is currently rated A- by AM Best and is assigned a stable rating outlook. In their most recent report, Best notes the company’s solid level of capitalization, positive earnings history and relatively liquid investment portfolio.

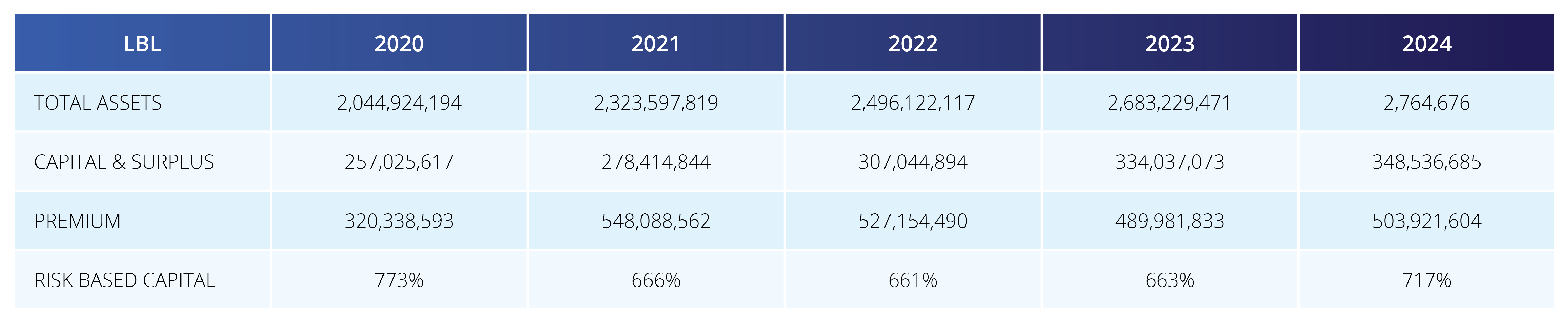

Liberty Bankers Life Insurance

Liberty Bankers Life Insurance Company (LBL), originally known as Royal Oak Life Insurance Company, was incorporated by Pilgrim Life Insurance Company of America in the Commonwealth of Pennsylvania in 1958. Over the course of 40 years, the company grew slowly and steadily, developing experience in offering a variety of traditional life insurance products across 40 states, as well as annuities.

By 2004, under the ownership of Heritage Guaranty Holdings, the company’s assets reached $200 million. Management then embarked on an aggressive expansion strategy, broadening its product offerings and sales force. Liberty Bankers Life provides a range of traditional life insurance products, including whole life, term life, and critical illness coverage.

Through strategic mergers and acquisitions, which included American Benefit Life, Winfield Life, Capitol Life, and Continental Life, the company achieved steady growth in both life insurance and annuity sales. Today, we market our products in 47 states through a network of more than 10,000 insurance professionals. National Underwriter magazine consistently ranks LBLIC among the top 100 annuity providers in the United States. More recently, we introduced Medicare Supplement products in 2016 and Critical Illness and Accident products in 2018.